Last month an FT writer (“Fiatbro Times” per Saifedean) by the name of Brendan Greeley was on the receiving end of wide ridicule for demanding that people stop calling government money “fiat.”

Greeley’s creative argument was that people say governments “magic dollars out of thin air” when, actually, governments magic dollars out of thin air then buy real stuff with it. Stuff like government debt or one third of all the mortgages in the United States. He therefore demands we call these magic thin-air dollars “credit money.”

Greeley was particularly upset at a tweet by prominent Bitcoiner Cameron Winklevoss, who wrote, “All money is a meme. All money is both an idea and a matter of faith or belief in it.” Greeley spent the rest of his essay imagining what “backs” fiat.

So that’s the question this week: is fiat backed by anything, or is it just a meme.

First, what does it mean for a money to be a meme? I take it to mean something whose price isn’t based on anything real, rather based on subjective opinions. Considering Bitcoiners seem to widely accept that dollars have mass, can be seen, and are, say, flammable, I’m going to assume the question here is not physical instantiation of the dollar but its price.

So, is the price of a dollar based on anything more than subjective opinion?

Every Future Number is Imaginary

For starters, every price is to some degree “backed by meme” in the sense that it’s based on things that aren’t real – aren’t real yet, anyway. For example, you might think gold, land, or a tonne of processed coffee beans has value. You think this because you have expectations about future demand, supply, and preferences.

Now, you’ll almost certainly be wrong to some degree about all of these. Hence you’ll almost certainly be wrong about the future price. Indeed, if you could perfectly predict coffee bean prices then you’d be the world’s first billionaire bean speculator.

Still, you have a good enough idea that you’re usually in the ballpark. If you’re a pro speculator you’re probably closer. And the market, being nothing more than the aggregate opinions of every speculator, is usually closer still.

This means buying, or not buying, anything whatsoever is subjective to the core. It’s speculating about future supply and future demand. Memes all the way down. Memes based on real things, to be sure — how many arable acres, how fast it takes to build a house, how scared the Fed will be about inflation next year. But all subjective guesses.

Now, for most goods, there could be thousands of relevant factors that go into demand and supply. Indeed, this is why competent investment analysts and asset traders are paid so much. And these thousands of stories – “investment hypotheses” in the lingo -- are all unfolding in a future that is, fundamentally, unknowable. It’s made-up. Imaginary. A meme.

And, yet, as with our coffee beans, the market has a pretty good idea. Never perfect, of course, which is why market prices fluctuate. If the market was too optimistic yesterday the price will go down today. And if the market was too pessimistic yesterday the price will go up today. So, to guess the future price of a dollar, as with coffee beans or Bitcoin, we take educated guesses about future supply and future demand.

And that’s where the memes come in. Because ideas change expectations, and expectations make future prices.

The Power of “Fed go Brrr”

Every time a “Fed go brrr” meme is enjoyed, or the NY Times expresses concern about inflation, the future value of USD statistically goes down or up a tiny bit. This is because “the market” is simply shorthand for the aggregated opinions of all the people who are, or could, participate in a given market. If a single potential participant adjusts their supply expectation for dollars, then they have statistically changed the present price.

Now, did the “Fed go brr” meme communicate a truth that turned out closer to market expectations — was it “real”? Or did the meme instead create a new misperception? We won’t know until the future actually happens.

What Has the Fed Done to our Money?

So what are these subjective drivers of USD? Supply, since demand is relatively stable unless supply goes bonkers. Whereupon people “lose faith” and mass-exodus in what Mises called the “flight to real values” and history calls “hyperinflation.”

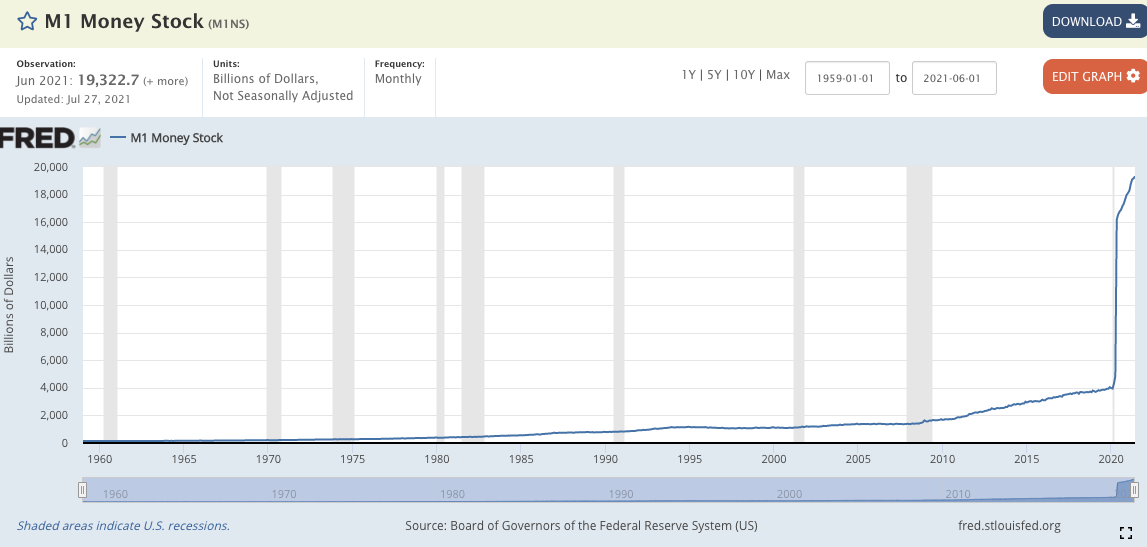

So what’s been happening to USD supply? In raw numbers, the number of USD in existence has grown at an accelerating rate since the US went off the gold standard. It’s now, of course, gone into overdrive in the wake of Covid.

From 1959 to 1969, narrow money (M1) grew at about 4% per year, going from $142 billion in 1959 to $204 billion in 1969. Then, after Nixon broke the gold standard in 1971, m1 accelerated to 6% per year, going to $4 trillion by January, 2020 — the month before Covid.

This means that, over these 60 years, your dollars were losing 4-6% of their value per year from the Fed siphoning off purchasing power, set against whatever deflation was happening from technology and population growth. This was experienced “on the ground” as inflation, and resulted in a nearly 90% drop in the value of the dollar measured in goods.

As we now know, since Covid this acceleration has gone into warp-speed, hitting an annualized 24% growth in the nowadays more representative m2.

And, so, if nothing else changes, this pace would imply a dollar that loses half its value every 3 years (!) So, yes, it very much matters whether Fed goes brrr.

The Bitcoin supply story, of course, is a very different picture. Bitcoin supply, from inception, has done what it’s always done: halve its supply inflation rate every 4 years. Rather than the dollar’s 4% going to 6% going to 24%, Bitcoin supply went from 8% to 4% to now under 2% per year.

It will drop to under 1% in 3 years, putting it below gold’s inflation. Then on and on, halving every 4 years until it asymptotically approaches zero inflation. Indeed, since coins are lost from circulation — sometimes on purpose — Bitcoin may already be deflating, and will be soon.

So, Are Dollars Backed At All?

So now let’s address the core claim here, which is that dollars are backed by anything other than meme.

Namely, defenders like Greeley and others claim the reason the dollar isn’t just a meme is because dollars issued by banks are “secured by the banks’ portfolio of loans.”

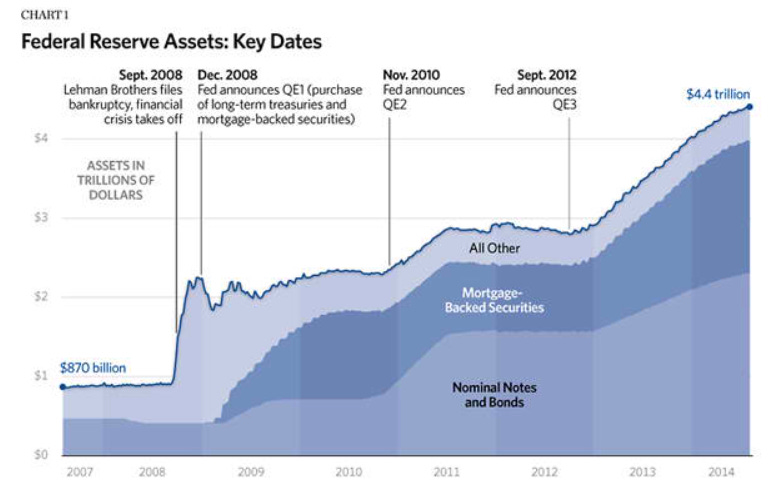

What are these loans? Mostly mortgages and government bonds.

And what backs them if those portfolios turn out to be insufficient? Well, the central bank.

Ok, what is the central banks holding? Uh, more government bonds and mortgages: since 2008, about 70% of the Fed portfolio is government bonds, and about 30% is in mortgage-backed securities.

Ok, so your bank account is backed by government bonds. Who pays those bonds? Why, taxpayers. You.

So, in short, your bank account is “backed” by governments’ willingness to take money from you, the taxpayer, to bail out the Fed so that the Fed can bail you, the taxpayer, out. You pay your own bailout.

Cute, right?

It’s actually not the only self-licking ice cream cone in the “fiat is backed” hustle. Because we haven’t even gotten to the meat of it: our old friend, purchasing power.

Purchasing Power: Central Banks’ Siphon

Remember all those trillions of mortgages and bonds are all denominated in nominal dollars. Dollars backed by dollars. This, effectively, obliterates the backing. Because you don’t care about the face value of an asset, you care about what it can buy – the dollar’s purchasing power. Weimar Germans, after all, went from being rich with 100,000 marks in the bank to eating garbage with a trillion in their pocket. Face value is worthless, it’s always what it buys.

So, to illustrate, today there are roughly $20 trillion US dollars in existence, and our economy coincidentally produces about $20 trillion a year. Let’s say you have $100 in the bank, currently worth 20 milkshakes at $5 per bundle of joy. The bank tells you your money is safe, showing their $100 portfolio of mortgages and reminding you that, push comes to shove, the Fed can scrounge up your measly hundred bucks. Good enough, you sleep sound.

But something funny happens overnight: the Fed unleashes the presses. Maybe the government needs more money, maybe Wall Street wants another bailout. Either way, you wake up in a still-$20 trillion economy but with $40 trillion dollars sloshing around. So now prices jump and a milkshake goes for, say, $10. Your $100 no longer buys 20 milkshakes, now you’re down to 10.

Where did the other half go? The fed handed them out to bureaucrats and bankers while you slept. Who, in turn, drank your milkshakes. They drank them all up.

Now, to be sure, your original face value is more backed than ever – the Fed could now, if they wanted to, bail-out your $100 roughly 160 billion times, up from yesterday’s 80 billion times. Rejoice, your money is safer than ever!

And yet you’ve just lost half of it. Poof, gone, with no recourse. If you try and go to the bank and demand your original 20 milkshakes in value they won’t even understand the question. They assume you’re an idiot and, slowly, say something like, “Sir, we don’t set the price at McDonald’s.”

You try and explain that it’s not just McDonald’s, it’s the gas station and Walmart, too. At this point they get impatient and start signaling security, “Sir, we’re not the gas station either. Are you feeling alright?”

What happened to all those glorious trillions in sterling solid backing? The most sound banking system the universe ever saw? They were an illusion. Because it was the little numbers they were backing, not the actual value of your money. Not what it would buy.

Why Central Banks Cannot Guarantee Your Dollar

Why is your purchasing power not backed? Because central banks don’t actually own anything. They have nothing more than a little siphon that they use to steal from savers and fixed earners. Asking them to guarantee purchasing power would be like asking a gasoline thief to make his victims whole by siphoning off yet more of their gasoline and giving it to them. It’s a basic physics problem.

And so, ultimately, the Fed guarantees your nominal dollars impressively, and it guarantees your real dollars — their purchasing power — at precisely zero.

Indeed, it cannot guarantee your purchasing power since that purchasing power is precisely what it swiped to buy anything at all. The Fed does not raise sheep or even make license plates in the basement. It is nothing more than a siphon to redistribute purchasing power. It cannot back anything.

This is why Americans, by the way, have twice shut down central banks once they understood what they are. And probably will again.

And, so, to answer the original question, because the purchasing power of all fiat money is not and cannot be backed by central banks, the value of a dollar is indeed based on nothing more than guesses. Some of these guesses will turn out accurate, others will not, but indeed the value of a dollar floats on nothing more than meme.

Thanks for reading, and subscribe for weekly updates. See you next time!