Bitcoin, Deflation, and Prosperity

Deflation is prosperity.

One common critique of Bitcoin is that it’s deflationary and therefore bad for the economy. This is based on an odd bit of Keynesian dogma that confuses deflationary crises with deflationary growth.

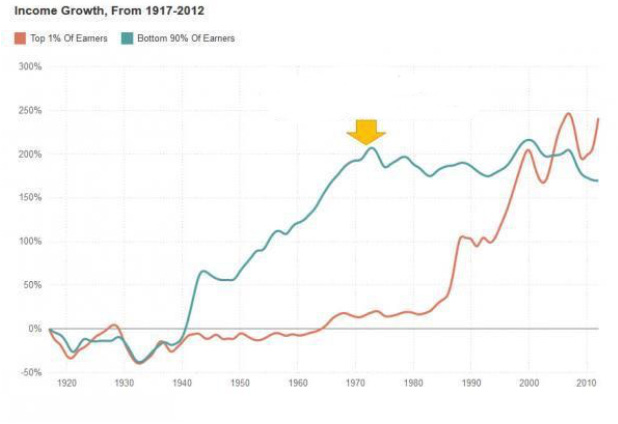

In fact, America’s greatest economic golden age was solidly deflationary and, indeed, golden ages throughout history are born in deflation. They generally sustain as long as deflation sustains, potentially for centuries, and it’s actually the inflation that marks the beginning of the decay. We are living through one such inflection today; for the gorey details browse WTF Happened in 1971 .

This pattern repeats through history, from the Roman Empire to China’s Song Dynasty to our own Victorian Era: deflation makes golden ages, inflation kills them. Because deflation is the natural state of a growing economy: it means a given amount of money buys more stuff than yesterday. Implying we have more stuff than yesterday. Which is the definition of prosperity.

In fact, inflation used to have a very different meaning: it meant a rise in the amount of money in circulation. Meaning deflation was the opposite – a fall in the amount of money in circulation. This definition shifted in the early 20th century to mean a change in consumer prices – when gas, or toilet paper, goes up in price. So, today, economists have to specify “supply inflation” or “price inflation.” (For the record, Bitcoin is price deflationary, but mildly supply inflationary until 2140.) The Cleveland Fed blamed Keynes for this word play and, since quantity and price are related, it isn’t completely insane. But it’s important to understand how it confused mainstream economists.

Briefly, mainstreamers mix up crisis and quantity, because economic crises do two things that boost the value of a dollar: they make people save more, and they turn debts bad. Both remove dollars from circulation, either because those dollars are buried in the backyard or they’re written off. Both make still-circulating dollars more valuable – each one buys more stuff.

But note it wasn’t the rising value that caused the crisis, it was the crisis that caused the rising value. Just as an umbrella doesn’t cause rain, supply deflation does not cause crises. In essence, mainstream economists today fear umbrellas because the roof leaks.

So, with that background, WTF happened in 1871?

The period starting around 1870 was interesting for two reasons. First, it is by far the longest modern period of deflation, running broadly from 1873 to 1893 and, arguably, through 1914. Second, the period was by far the most economically vibrant in American history, arguably in world history.

If you’re American, you learned about this period as the “Gilded Age,” a pejorative coined by socialist journalists. If you’re a mainstream economist, you know it as the “Long Depression,” coined for the falling prices back when Depression meant something different than it does today.

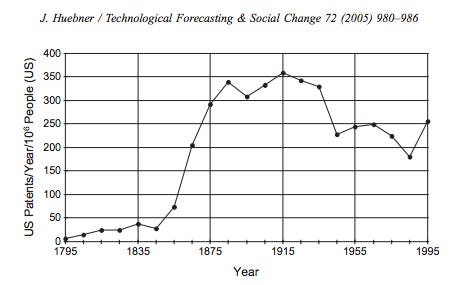

In reality, this was a defining Golden Age, a stretch when essentially the entire modern world was invented in a single go. The pace of innovation is dazzling even today: A partial list includes electricity, automobiles, telegraph, telephone, airplane, steam turbine, video, wireless communications, broadcasting, plastics, stainless steel, the first analog computer. We went from whale oil to gas stoves, from candles and coal to walls of light and central heating. From Pony Express and horse-drawn carriages to radio, telephone, and automobile in a single generation.

As Murray Rothbard writes, it was “an extraordinarily large expansion of industry, of railroads, of physical output, of net national product, or real per capita income” featuring modern Singaporean levels of GDP growth – 6.8% per year during its most “Depressionary” stretch -- and a level of technological change that astounded those who lived through it.

Indeed, this Age felt like Sci-Fi to those who lived through it, a Kurzweillian Tophat Singularity. In fact, the era did give us modern science fiction, with pioneers like Jules Verne and HG Wells.

Unfortunately, it also ended. Over the following century, this Singularity went into exile as we squandered it to the point that, today, we laugh at the optimism of the late 1800’s. Their flying cars, robots in every home, cities floating over the earth seem absurd to us only because we don’t realize what we’ve lost by failing to safeguard against the socialists who try to kill every golden age.

Contrast our technology today, in this inflationary fiat era. Between 1990 and 2020, outside medicine, the most important and novel thing we’ve invented is, ironically, Bitcoin. Sure, regulators finally let us use the internet, fully developed by the 1950’s then delayed decades by commercial prohibitions and, at any rate, a technology based on the telegraph (1849).

Even Elon Musk’s revolutions build directly on electric cars (1890) sold on mobile phones (1908), with sidelines in solar panels (1888), rocket science (1903), and subways running in pneumatic tubes (1870). As Peter Thiel has warned, we teeter on the edge, not just of stagnation, but outright regression. The hallmark of an inflationary age.

As for Bitcoin, the prospect of returning to a deflationary world shouldn’t scare us in the least. On the contrary, deflation is the companion of prosperity, the signature economic feature of history’s golden ages. Criticism of Bitcoin’s price deflation gets it exactly backwards, then: In reality, deflation is prosperity, inflation is poverty.

If Bitcoin helps free us from an ever-growing statism stultifying our economy, constraining innovation, and debasing the money on which both limp along, it will have achieved one of the greatest advances in a century.

Thanks for reading, and subscribe for weekly updates. See you next time!

Well said Peter.

Since about 2007-8, as a result of studying the unfolding financial crisis back then, I have been obsessed with the topic "cost of living" - and everything that I have learned tells me that "deflation is prosperity" - because it reduces the cost of living, and therefore expands economic opportunities, and increases the quality of life. I am fortunate to have lived in Thailand since 2004 and I have also learned oodles from the Thai people's way of life, 50% of whom and still farmers, and they don't buy into this attitude that farming is "the grind of poverty."

The ugly truth is that the entire world is awash in the disinformation that has been created for hundreds of years by the globalists who created global capitalism as we know it today, which I refer to as "fascist capitalism" - where everything must be monopolized by the owners of global capital, the central banks, the international banking cartels, and multinationals.

All of which is not spreading prosperity, it is spreading wealth and income inequality and poverty.

Anyway thanks for the article, thanks for the follow on Twitter which is what led me here.

Ivan M. Paton