There’s a lot of confusion about bitcoin’s final destination if it “wins.” Proponents cheer an infinite Bitcoin price, either metaphorically or sometimes literally, while “nocoiner” critics claim that Bitcoin won’t work as a money because nobody would buy, or lend, in a currency that goes up forever.

Meanwhile, journalists panic that infinite Bitcoin would mean infinite energy use. The confusion, and FUD, mounts from sci-fi speculation about Bitcoins that go up forever until we run out of zeros and crypto-zillionaires own all the things.

Alas, for better or worse, infinite price isn’t how it works. In fact, we know exactly what happens when a new currency emerges, because it’s happened many times in history. Maybe not infinite times, but close.

In his excellent Bitcoin Standard, Saifedean Ammous details how, throughout history, harder commodities like precious metals have replaced less-hard commodities like agricultural products, beaver skins, or rocks. In fact, it happens today, with US dollars replacing Zimbabwe paper or Venezuelan Bolivars. And none of them go to infinity — not gold, not dollars.

The reason, and a key insight of the Austrian School of economics, is that money is an economic good like any other, with a finite demand that comes from two specific things money is good at: buying stuff, and storing value to buy stuff later. Exchange and savings. That finite demand then crosses supply to give a price, giving us the familiar graph that some Austrian economists tattoo on their biceps.

Keep in mind that “buy stuff later” needn’t happen in the same money. For example, in countries like Mexico, it’s common for people to park their savings in US dollars even though they need pesos to buy everything around them. As long as they think dollars will hold value and remain tradable for pesos, when the medium of exchange is inflationary, people actually prefer to save and spend in different monies.

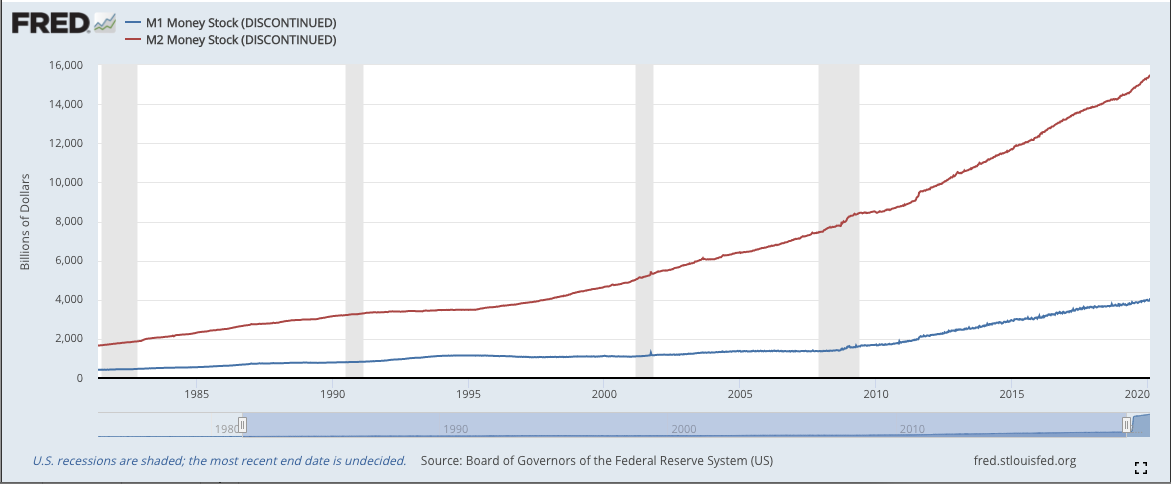

Now, between these two kinds of money demand, savings are far more important than transactions, whether measured in official monetary aggregates (M1 vs M2) or, intuitively, by how much money is in your bank account compared to your pants pocket. This, indeed, is why Bitcoin is worth so much in the first place — it’s fantastic for growing your savings, but much less fantastic for day-to-day transactions.

So, simply because money is a regular good with finite demand, Bitcoin won’t have an infinite price. Just as paper money today doesn’t have an infinite price, nor did gold or silver for the millennia they served as money.

Ok, if not infinity, how much will it be?

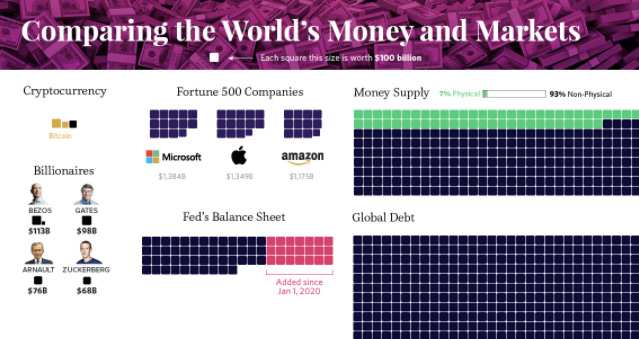

The simplest estimate is divide all the money by all the bitcoins. Today there is roughly $400 trillion in worldwide wealth, but only 20% of that wealth is held in currencies, with the rest parked in other assets like houses, stocks, or durable goods with resale value in a pinch. People own these things instead of money either because they get some benefit from owning it, like with a house, car or painting. Or else they own it because they think it will rise in value in future, like a stock, gold, or Bitcoin. Sometimes it’s both, like an antique car or a Jackson Pollack.

So assuming we continue to use houses and cars, even chairs, and that we still invest in companies, speculate on assets, and enjoy looking at paintings, Bitcoin won’t gobble up that $400 trillion, rather it has to make do with that 20% currency share of about $80 trillion.

Now the easy part: divide that by the number of bitcoins which, unlike paper money, we know exactly how many exist: 18.6 million. We can knock off the roughly 20% of bitcoins thought to be lost and we get a price of $5.3 million per bitcoin. About 5c per satoshi. So today’s coffee might cost 100 satoshi, a beer 200 satoshi, and a Papa John’s pizza might fetch 400 satoshi.

Psychologically, if you’ve ever visited Mexico or Thailand, a satoshi would feel like a peso or a baht. And, like today’s tourists, after a week or two of remembering some rule like “knock off a zero and cut it in half,” people gradually start thinking in satoshi.

After a couple years under such a Bitcoin Standard, the idea of paying $5 for a cup of coffee (and a little more next year), will feel foreign to people used to paying 100 satoshi for a cup of coffee (and a little less next year). Kids won’t marvel how cheap stuff was for their grandparents, rather they’ll marvel how expensive it was the way kids today marvel how mobile phones cost $4,000 in 1980.

Incidentally, assuming the market has a similar analysis in mind, it implies the market thinks that there’s, at most, a 1% chance that Bitcoin becomes the world currency — $55,000 vs $5.3 million. And it implies that if those odds rose to, say, 2% then that alone would double Bitcoin’s price.

Even this is probably a big understatement since most of Bitcoin’s value derives from the work it does each day protecting and serving, rather than speculation on reserve currency status. But the important point is that even a very low likelihood of Bitcoin’s succeeding justifies a very high price.

Now, obviously, this $5.3 million estimate is only a start. Because Bitcoin world probably looks very different from today’s world, both in terms of institutions and human behavior. But, for now, the point is hyperbitcoinization doesn’t mean infinite price, rather it means satoshis that spend like pesos or baht. They might be somewhat higher, somewhat lower, but their buying power will be based on real usage and finite demand, not infinities.

So that brings us to the interesting part: how does a Bitcoin world differ? A lot will depend on what path we take from here to there: Is it little by little or all at once? How do governments or other monetary incumbents resist, and how does that resistance affect timelines and path dependency of adoption? And, when that resistance fails, do those obsolete institutions negotiate some ongoing relevancy or power to keep their sticky little fingers in the money game?

Then, of course, there’s the big one: how do we ourselves change. How does behavior change in a world without permanent inflation, without obese governments fattened on free paper, without low or negative rates forcing us to take financial risks we didn’t want, and without financial crises that keep us perpetually dodging financial rocks flung by bankers and their government pets.

Finally, how many multiples higher might savings be in a world that protects wealth and, hence, is far more prosperous than what we endure today. All of these could dramatically increase currency demand in a Bitcoin world, such that Bitcoin’s price could substantially rises beyond even that $5.3 million start.

Now, what happens to inflation the day after that $5.3 million per Bitcoin? If it happens this year, new bitcoins would continue being mined at a 330,000 annual pace. Meaning there will be 1.8% more bitcoins in a year than today -- comparable to gold mining. On its own this supply inflation would reduce Bitcoin’s price 1.8% this year. But, of course, we have to set that against rising demand, if only from a growing world population and economic growth.

At today’s population growth (1%) and today’s real per capita economic growth (2.5%), you get a 3.5% rise in demand if nothing else changes. Subtract the inflation and you get a 1.7% annual rise in bitcoin’s purchasing power this year. In practice, people won’t see it as bitcoin rising 1.7%, rather they’ll see it as beers and pizza getting 1.7% cheaper. Just as today most people don’t see it as a shriveling dollar, they see it as beers and pizzas getting more expensive.

Going forward, that growth in purchasing power would improve as Bitcoin’s supply inflation comes down. So, given that Bitcoin asymptotically approaches zero supply inflation, the full 3.5% from population and growth eventually goes directly into rising purchasing power, all else equal.

Next, we can use this basic framework for fun scenarios. For example, if you think a Bitcoin economy grows faster, simply plug that in: not 1% population plus 2.5% growth, rather 1% population and 5% growth for 6% improvement in purchasing power. It’s similarly easy to include changes in savings or transaction demand, laying something like 2% growth in demand on top of that population and growth as an inflationary generation is replaced by thrifty kids who grew up in a sound money world.

In both cases, keep in mind that some of that future growth will be capitalized in the value of Bitcoin, just as future inflation is built into today’s pesos and baht. This means Bitcoin could overshoot that $5.3 million but, again, it would be finite and would be based on global time preference. Which at the moment is unknown thanks to global interest rate manipulation, but historically ran around 5%.

In sum, a world running on a Bitcoin Standard would be totally familiar to us today, yet better in important ways. It might be a world where creation pays light years better than conflict, where you can enjoy the fruits of your hard work without schemers siphoning your life savings while you sleep. A world where the next generation is excited by inventing things and solving long-standing challenges, rather than fighting one another in some Hobbesian cosplay that keeps us running to stay in place.

Thanks for reading, and subscribe for weekly updates. See you next time!

Very good and helpful. One path you do not mention is if government decides Bitcoin is a threat and tries to block or heavily regulate its use. This: "How does behavior change in a world without permanent inflation, without obese governments fattened on free paper, without low or negative rates forcing us to take financial risks we didn’t want, and without financial crises that keep us perpetually dodging financial rocks flung by bankers and their government pets." These things are not like bad weather. They happen because people benefit from them and make them happen -- powerful, wealthy, influential, connected people. They will not like facing something that makes it harder for them to do these things, to their benefit. They will not sit still while it happens. The big hurdle for Bitcoin and crypto generally is the regulatory, legal and political counter-attack, that seems inevitable. If it survives that, we really will be in a new world.

Wonderful! Thank you Peter.