Why Bitcoin Beats Gold

Bitcoiners are used to fighting champions of government money, but every so often a salvo comes from an unexpected corner: free-marketers. Those who remain skeptical of Bitcoin and instead pine for a monetary world that is, alas, gone.

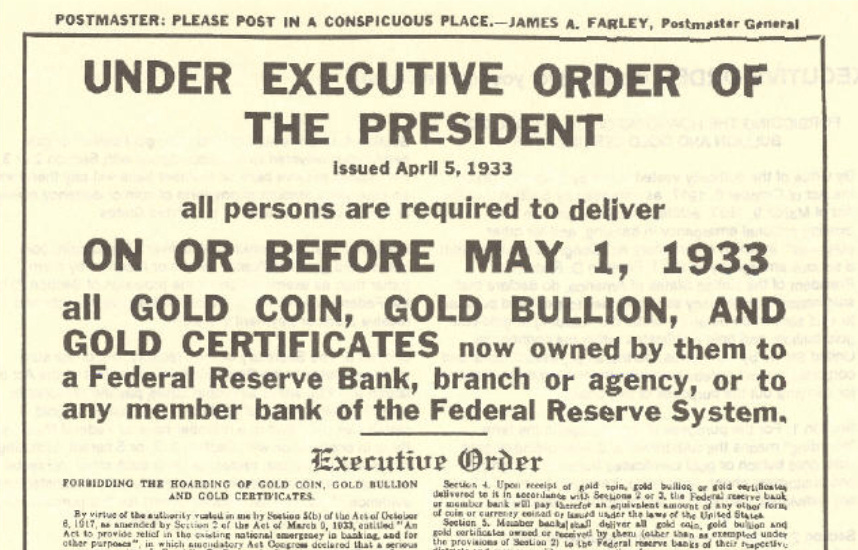

This friendly fire is usually from goldbugs who like gold’s physical backing and long history. The fight’s usually gentle, since they’re 90% of the way to Bitcoin, they simply haven’t yet appreciated gold’s flaws. Flaws that, ironically, stem from the very fact that gold is “real” in the sense you can drop it on your foot, but also in the sense that governments can drop it in their bag.

But sometimes the friendly fire isn’t from goldbugs at all, rather from a different group of free-markets promoting, not gold specifically, but any non-government currency, even unbacked paper money. These “Free Banking” critiques don’t get much response from Bitcoiners. And, in fairness, unbacked currency living on a spreadsheet does reduce gold’s physical problems. So I figured a response is due.

First off, I should note that I’m a huge fan of Free Banking, indeed of getting governments out of money and finance altogether. Free banking scholars such as George Selgin and Lawrence White were referenced in the earliest Bitcoin discussions by Nick Szabo, and likely had a tremendous influence on Satoshi. So respect to the Free Banking OG’s.

Having said, I think crypto has taken the discussion far beyond what Free Banking advocates had in mind. Taken it to something far more resilient to government, and therefore far more powerful. Indeed, I’d argue that to champion Free Banking in 2021 is to champion Bitcoin as the layer on which it builds.

The specific article I have in mind here is by Steve Hanke and Robert Simon, called “Beyond Bitcoin, It’s Time for Cryptocurrency Boards.” Hanke works with Cato Institute’s Sound Money Project which, despite its name, is consistently Bitcoin-skeptic (for a taste see Cato’s unfriendly review of Saifedean Ammous’ excellent Bitcoin Standard). Outside crypto, Hanke does important work fighting hyperinflationary fiat at the Troubled Currencies Projects. So he understands markets, he understands currencies, and he is not naive about central banking.

In their article, Hanke and Simon argue for “private cryptocurrency boards” instead of Bitcoin. These would be non-government organizations based in, say, Switzerland that would issue tokens backed by “a currency issued by a central bank, or gold.”

The idea is that you could capture the benefits of crypto as electronic money, while avoiding what Hanke and Simon think are Bitcoin’s problems: its price volatility, its high fees, and the fact that governments are investigating or scrutinizing projects like Tether and Facebook.

Now, Bitcoiners in general dismissed the proposal, some probably rudely. Because they see the whole point of Bitcoin as escaping an inflationary money printed by a bunch of guys sitting around a table in nice suits and nicer booze. It doesn’t matter if that table is in Zurich or Washington if the board is using “a currency issued by a central bank” — as in, issued by a government, presumably the US government. Meanwhile, a gold-backed crypto would simply re-import gold’s physical vulnerability to existing crypto – it would be reinventing the bitcoin wheel, but worse ( Read more here).

Beyond these solid responses, there is an even more fundamental problem with private currency boards, indeed with Free Banking in general in 2021: both rely on governments embracing, or at least tolerating, a competitor. The past few decades have illustrated rather clearly that modern governments do not at all like money that’s outside their control, such that they either take it, or they will kill it.

We have excellent evidence from Hanke and Simon’s very examples. In the case of Tether, auditors were afraid of running foul of governments and refused to work with it. While Facebook’s project has been a magnet for government intimidation ranging from US Senators threatening partners to a multinational regulatory “backlash” including promised bans by France and Germany, presumably with more to come. Given Facebook itself is in the regulatory crosshairs, the project may not be worth the intimidation, and certainly serves as a warning to others. As governments toy with launching their own CBDC’s, this intimidation will likely worsen.

Indeed, economically, such a “private cryptocurrency board” amounts to reinventing the stablecoin, but a stablecoin that governments like, rather than the ones we already have that governments threaten to destroy. Why would governments like it? Hard to say unless it’s simply a licensed CBDC. In which case why not cut out the middleman and go full China, which I assume Free Bankers do not want.

Ultimately, there is a reason why Bitcoin alone reached up to 100 million users and $1 trillion in market capitalization while surviving government intimidation for over a decade now — a feat that precisely zero private currencies have managed in the previous 50 years of many tries. And that reason is that governments hunt private currencies like cokeheads hunt lickable surfaces in disco bathrooms. And when they get ahold of one, they drown it, the methods ranging from unlicensed money transmitting, money laundering, counterfeiting, or whatever made-up sin offends monopoly money.

The result is that governments no longer allow private currencies to live if they are centralized. Only Bitcoin survived because it simply cannot be killed, then other crypto, for the moment, snuck in on precedent for who knows for how long.

This hunt and destroy stance, of course, predates crypto — indeed it has been true whether the currency was gold backed or whether it relied on trust and brand as in Scottish Banking or America’s Suffolk System. Systems that worked beautifully, disciplined by customers and the market. But that, alas, were killed by inflation-hungry central banks auctioning or seizing seignorage as a money-printing license. Giving us a world where even though Free Banking is obviously superior to what we have, and has proven itself time and again, out of 195 countries precisely zero has Free Banking today.

Instead, in this take-no-prisoners monetary world in which we live, the moment that hypothetical private currency board dusts off the mahogany table in Zurich -- before it even pops the bubbly -- it will face a choice: Join or Die. Join the central banking borg, or be strangled in the crib long before you make the front page of anything. Only Bitcoin can survive.

Now, I'm certain that, deep inside, Free Bankers dreaming of centralized private currencies know this problem. Why? Because they are admirably skeptical of government’s intentions in every other realm: they love non-government schools, airports and supermarkets, they love yet more ardently non-government monies, banks and currency boards. Indeed, anything non-government under the sun so long as it’s not a crypto in existence today or, more specifically, so long as it’s not Bitcoin, the single crypto that actually does what they want.

I can only speculate why the pattern, but I do hold out hope that rather than reinventing a worse wheel, Free Bankers can focus on why Bitcoin alone survived that gauntlet. To understand Bitcoin’s strengths and the real-world problems Bitcoin is solving in the here and now thanks to its social layer, its brand and stakeholder loyalty, and its incentive structure. As opposed to spherical cows that work on paper.

Private currencies or Free Banking based on gold, paper or database entries are all super in a world of benign governments peopled by helpful regulators who grasp markets and seek to maximize happiness. A world we all, Free Banking advocates included, know full well does not exist today. Meaning that neither private currency boards nor Free Banking stands a snowball’s chance. Only Bitcoin’s resilience, its sovereignty resistance, and its immense infrastructure give it that shot.

And so, taking the world we have rather than the world we wish we had, Free Banking is indeed a wonderful idea, but only Bitcoin fixes that.

Thanks for reading, and subscribe for weekly updates. See you next time!